There’s been a lot of talk in recent times about whether or not degrees are even necessary in today’s society. While it’s certainly true that some companies are open to hiring candidates without qualifications, many aren’t. Even if it’s possible to find employment without a degree, having one can help you go a lot further, much faster.

Not all degrees are equal, though, so this post will discuss which can be the most valuable ones.

Types of Course

When people think of prestigious degrees, their minds tend to go toward subjects like law, accounting, and statistics. However, some degrees that actually open more doorways (and can lead to higher paying jobs) in the United States include petroleum engineering, electrical engineering and computer science, applied economics and management, and operations research, with average entry-level salaries post-graduation being $94,500, $88,000, $58,900, and $77,900 respectively. That said, law, accounting, and statistics degrees are still great options and can help you find jobs in those industries.

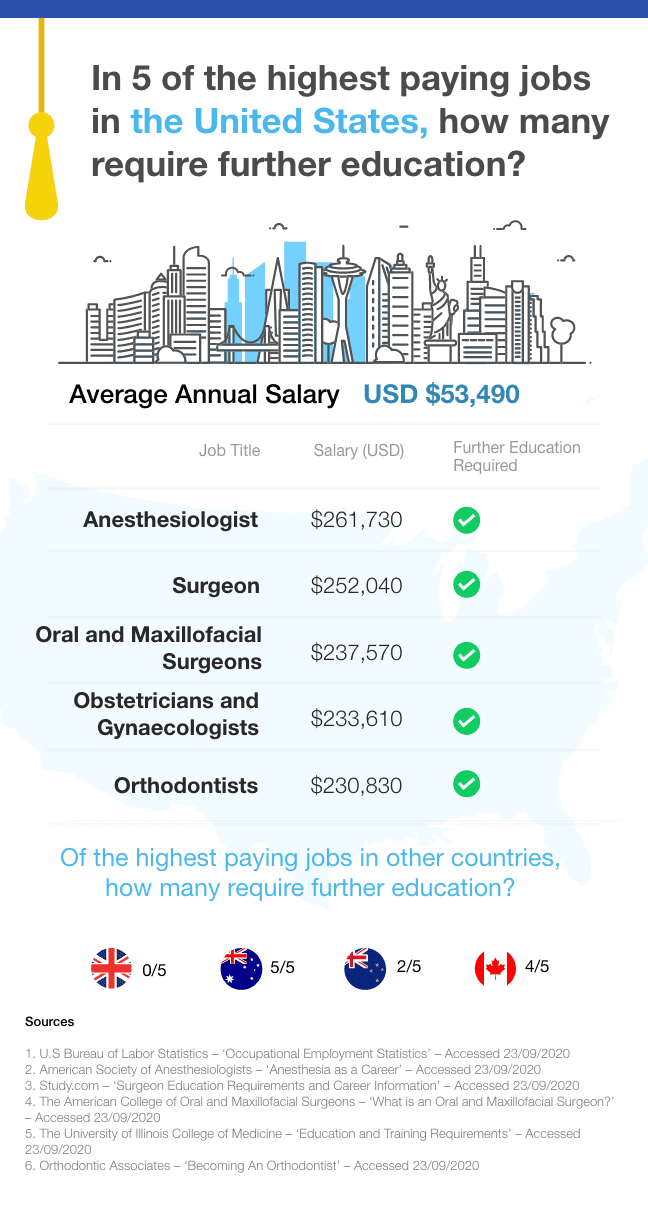

Below is a graph created by the people behind Comparethemarket.com.au’s income protection that explores the highest-paying jobs in the United States, far exceeding the salaries of those previously mentioned. It should be noted that all jobs listed below are medical, therefore making medical degrees best if you want a high-paying job.

Degree Duration

The duration of a college course can vary. Most bachelor’s degrees take around four years but can sometimes be concluded in as little as three. It’s also possible to take an accelerated bachelor’s course, which takes no longer than a year. A master’s degree, which follows a bachelor’s, takes around two years. Then, there is the Ph.D., which can take another three to four years. The Ph.D. is the most prestigious degree of all, requiring a huge amount of time commitment to complete such a course, not to mention they’re also costly.

Student Loans

According to a recent survey, the average student loan debt is $30,000, with graduates usually paying around $393 per month. However, graduates who don’t earn a lot of money often find paying this difficult, and there is always the risk of sudden unemployment because of illness or injury, which can further impact someone’s ability to repay their loans. However, with products like income protection insurance, it is possible to receive a sizeable portion of your usual monthly income for a fixed period. Therefore, taking out income protection insurance can help people to ensure that they can continue repaying their loans, despite illness or injury.

Paying Debts

On average, it takes graduates in the United States 21 years to pay off their student loan debt. However, it’s possible for some people to pay theirs much faster, provided they’re able to find a high-paying job post-college. Unfortunately, interest is charged on student loan debt in the United States, making it very difficult for people with low salaries to clear off their debt quickly.

Degrees can help you to maximize your income. However, you first need to find a degree that interests you and that you think you will be able to complete. You also need certain degrees to access others (e.g., you can’t get a master’s until you have a bachelor’s). Bear all of this in mind if you plan on studying at college.