If you’re from Australia, you’ve probably at least heard of PayID. If you haven’t used it already, you may have a question about how to use QR codes with PayID. Your PayID is technically your mobile number, email ID, or some other identifier that you couple with your baking app.

This way, when you’re transacting, you won’t have to share your bank account credentials with the other party. Instead, you can transact via only your PayID. To make sure that you’re sending the payment to the right person, just check the confirmation screen – it will display the name of the recipient. Receiving money is also just as simple!

And you can integrate your PayID with your blockchain account, crypto wallet, mobile banking app, and so on. Plus, just because it is simple does not mean that it does not employ robust security and verification mechanisms (it does) which will allow you to pay for entertainment, for example, in a casino with a PayID account. PayID also integrates perfectly with QR codes, which makes life a whole lot easier.

How To Use QR Codes With PayID In Bank Apps To Make Payments

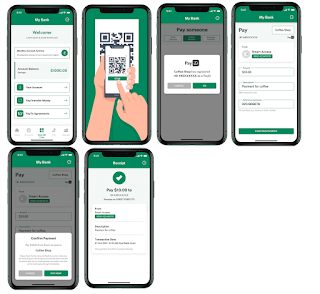

Using QR codes with PayID to pay for your meal or shopping is not complicated. Here’s how you do it (the specifics may differ slightly based on the specifics and version of your banking app):

- When the vendor presents you with the bill, they’ll also create a QR code with it.

- Once you get your bill, look for the QR code at the bottom (or top).

- Open your banking app (preferably via fingerprint unlock).

- Go to the “make payments” tab.

- Here, select the “scan QR” option.

- This will give the app access to your mobile phone’s camera.

- Use the camera screen to scan the QR code.

- You only have to hold the entire QR code in front of the camera lens.

- The QR code encrypts all the relevant transaction information you need.

- You won’t have to enter any information manually if you scan the QR code.

- You’ll get all the details on your screen, including the recipient’s name and PayID.

- Confirm these details with the bill.

- Hit “pay now,” and that will be all you have to do.

- Your payment will be processed in real-time after this.

Things can go differently in some cases. For instance, the retailer may show you their QR code from their mobile screen (by “generating a QR code” via their banking app – you can do the same). Or they may share a static QR code (not specific to your bill) encrypting their vendor information.

The overall process works the same in both cases, but you’ll have to manually enter the amount you wish to transact in the latter case. You can also go to the QR payments tab in your banking app, create a QR code for yourself, and use it to receive money without sharing your account info!

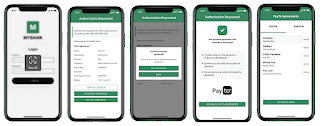

Using QR Codes To Create PayTo Agreements

You can also use QR codes with PayID to set up PayTo agreements, which allow the recipient (or the PayTo user) to initiate transactions when needed. But you have to approve it, to begin with. For example, you can set up recurring monthly payments for subscriptions (let’s say for a gym membership) via a Pay To agreement:

- Use the third-party app (for the service you’re subscribing to) to scan the QR code.

- Once you scan the code, you’ll get the option to create a Pay To agreement.

- You must.

- Once the agreement is in place, the Pay To User (in this case, your gym) will be able to deduct your monthly subscription.

This also applies to funding any digital wallets and your accounts for third-party apps. Once you set things up (using the same steps as the ones mentioned above), the app will reload your balance automatically when it falls below a threshold level.

You can also set up a Pay To agreement at a POS terminal, such as in a grocery store, where you get bonus credit in your balance when you purchase from that store by scanning the QR code at the POS via the grocery store’s app. You can even automate your bills this way!

Bottom Line

QR codes are highly convenient and lightning-fast! They can even help you automate your payments and subscriptions so you don’t have to worry about keeping track of your bills every month.

But be cautious; QR codes can and are misused for scams!

Never scan any QR codes without verifying their origin, especially ones you get in email or come across in ads or pop-ups. You can also look at the experience of Welsh Players Should Opt for PayID in the same way. Also, make sure that you always verify the PayID details before you initiate the transaction.